|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Insiders Just Grabbed Nearly $1M of This High-Yield Energy Stock

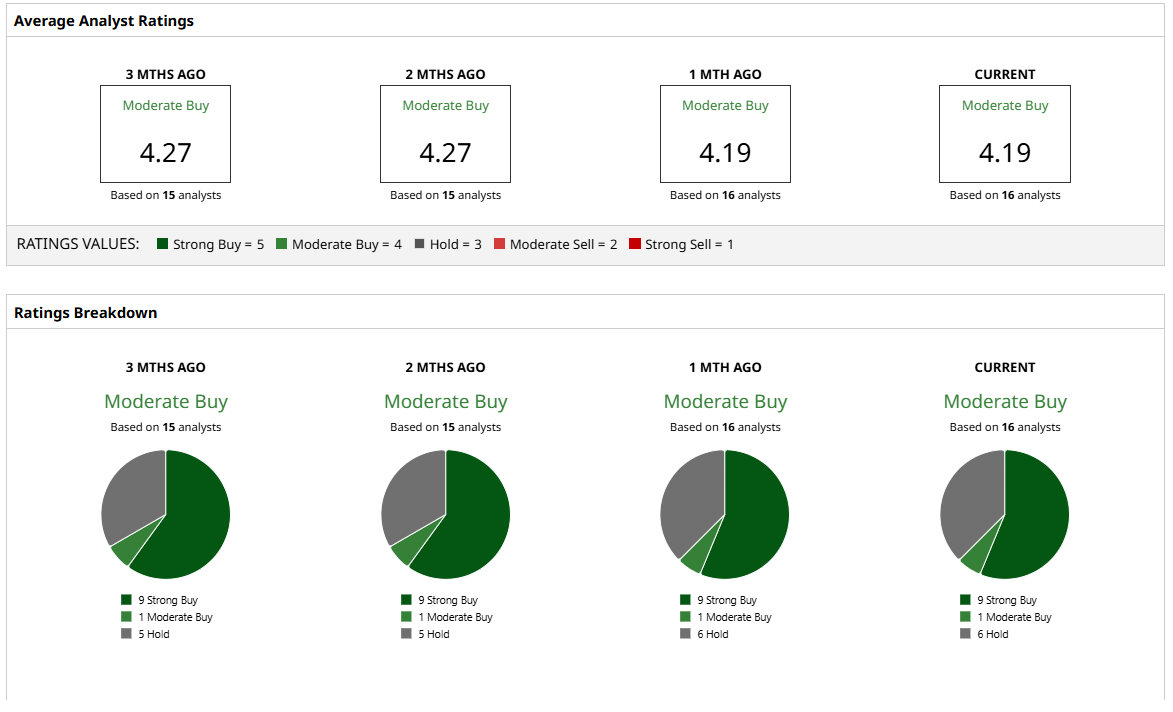

Capital continues to flow into energy infrastructure, particularly with Enterprise Products Partners (EPD) gaining attention due to significant insider buying and its consistent, high yield. The company, which delivers almost 7% annually, saw two board members make standout purchases at the end of July, putting nearly $1 million into company shares on July 29 and 30. This is the first time in almost a year that EPD insiders have bought in such size, instantly drawing a watchful eye from those tracking the stock. This strong show of insider confidence comes just as EPD reported solid second-quarter results for 2025 and keeps its leading spot in midstream energy services across North America. The partnership continues to deliver strong cash flows and is steadily widening its network. This buy-in stands out even more when considering EPD’s consistent growth in payouts and the continued strength seen across the whole energy sector. Let’s take a closer look. EPD’s Financial Performance in Focus Enterprise Products Partners (EPD) is one of the biggest names in the midstream energy space in America, handling the transport and storage of oil (CLU25), natural gas (NGU25), and natural gas liquids. EPD’s stock price is up 10.6% over the last year, showing its strength in a tough market. Its forward price-earnings ratio is 11.4x, sitting below the sector average of 12.57x, which means investors might be getting EPD’s strong cash flow at a discount. On the financial front, the company keeps showing solid results. Net income held at $1.4 billion or $0.66 per unit in Q2 2025, a 3% increase from the year before. Distributable cash flow for the latest quarter rose to $1.9 billion, up 7%, while adjusted cash flow from operations stayed strong at $2.1 billion. Total gross operating margin moved up to $2.5 billion from $2.4 billion a year ago, and EPD’s key NGL Pipelines & Services unit kept a $1.3 billion margin. With yearly sales at $54.8 billion and net income topping $5.9 billion, EPD’s financial foundation is a big part of why insiders and investors interested in reliable income keep coming back. Insider Confidence Meets Premium DividendThe timing of EPD’s nearly $975,000 insider share purchases stands out, especially given that the stock yields 6.9% compared to an energy sector average of 4.24%. On July 29, 2024, director John R. Rutherford put down $470,220 to buy 15,000 shares at $31.35 each, raising his stake by 10.4% to a total of 168,586 shares. The next day, board member William C. Montgomery bought 16,000 shares at $31.55 each, investing $504,800 more. Together, these buys are the first sizable insider moves at EPD in almost a year. This timing matters more when considering EPD’s dividend record. The partnership now pays out $2.18 a share each year. On top of that, EPD has grown its dividend for 28 straight years, giving it one of the longest running streaks in the energy sector. Its latest quarterly payout of $0.545 landed on July 31, 2025, just after the insider purchases were made. Analyst Perspectives and EPD’s Road AheadLooking at what’s ahead, expectations call for steady growth that backs up the company’s focus on regular dividends. For the quarter ending September 2025, analysts see earnings of $0.70 per unit, which is a solid 7.69% increase from the $0.65 reported last year. This trend carries on into December, with analysts expecting $0.75 per unit, though growth for that quarter slows to 1.35% year over year. EPD’s management aims to keep organic growth spending between $4 and $4.5 billion in 2025, then down to $2.0 to $2.5 billion in 2026, while maintenance costs should come in around $525 million this year.  Comments from analysts have stayed mostly positive, while still noting some challenges in the energy sector. Mizuho’s Gabriel Moreen has kept his “Outperform” rating and even raised the price target to $38, pointing to EPD’s strong operations. The 16 analysts tracked by Barchart give EPD a conensus “Moderate Buy” rating and the average price target is $36.40, suggesting a possible 12.5% jump from the current share price. ConclusionWith insiders making their first big move in a year and analysts forecasting further gains, Enterprise Products Partners stands out as a rare find for yield seekers. The nearly 7% payout, paired with a well-covered distribution and a management team still putting money to work, offers real confidence in the road ahead. While capital spending and industry headwinds remain worth watching, EPD’s stable fundamentals and persistent analyst optimism suggest this high-yield energy stock is well-positioned for both income and long-term growth. On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|