|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Walsh Pure Supply & Demand - Pure Hedge Division

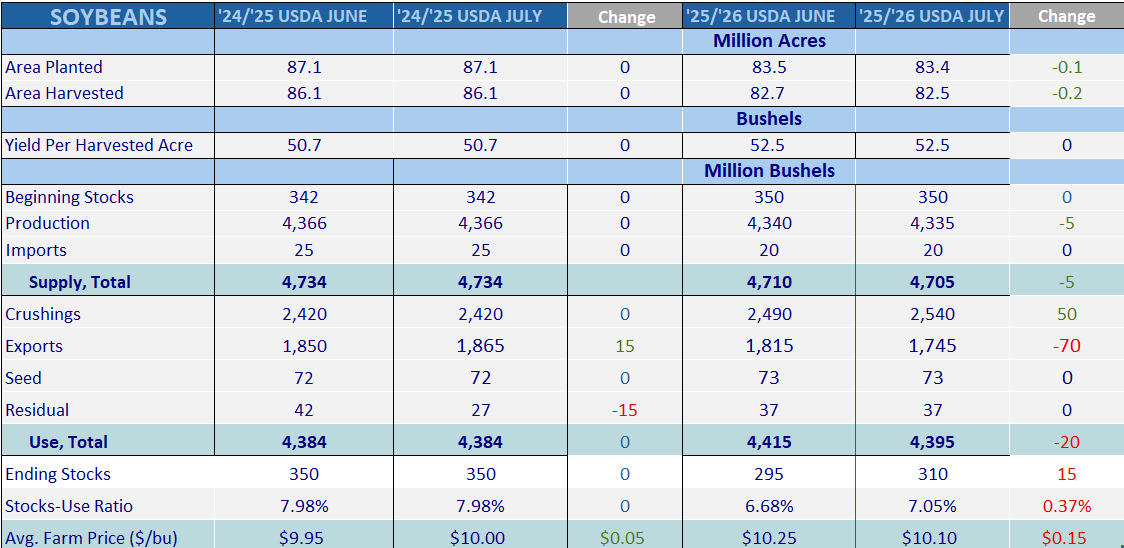

September soybeans made a high at 1006 3/4 and closed at 1005, up 17 3/4 cents. Forecasts are showing hotter weather for the next 11-14 days in the Midwest and eastern soybean growing areas. August is the key month for soybean development. If hotter weather does continue into next month, it’s likely that some weather premium is added. Monday’s Crop Progress report had soybean ratings up 4 points to 70% good/excellent. Louisiana and North Carolina lead soybean ratings at 92% good/excellent and 84% good/excellent. Michigan has the lowest soybean rating at 46% good/excellent followed by Ohio. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list  New cropOn Friday July 11th, the USDA lowered the planted area slightly from 83.5 million acres (ma) to 83.4 ma. Acreage was also reduced slightly from 82.7 ma to 82.5 ma. The USDA kept its yield estimate the same at 52.5 bushels per acre and lowered production by 5 million bushels (mb) to 4,335 mb. The USDA’s production estimate in June was 4,340 mb. Imports were unchanged at 20 mb, reducing the total supply to 4,705 mb. Crush was increased by 50 mb above the June estimate to 2,540 mb. Exports were lowered by 70 mb to 1,745 mb. No changes were made to seed and residual use. Total use fell 20 mb from June to 4,395 mb. Ending stocks were increased from 295 mb to 310 mb. The stocks/use ratio is now 7.05%, up 0.37% from June. Old cropLooking at the changes the USDA made to old crop soybeans, exports were increased by 15 mb to 1,865 mb. Residual use was lowered 15 mb, from 42 mb to 27 mb. The gain in exports was offset by the reduction in residual use, keeping total use unchanged at 4,384 mb. Endings stocks and the stock/use ratio were unchanged at 350 mb and 7.98%. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list WorldOn Friday, world beginning stocks were raised by 0.92 million metric tons (mmt) to 125.12 mmt, while world production was raised by 0.86 mmt to 427.68 mmt. Ending stocks increased from 125.3 mmt in June to 126.07 mmt, putting ending stocks at 29.7%. The huge difference between domestic stock/use and world stock/use shows how abundant the global soybean supply is. If you’re interested in browsing hundreds of automated trading systems that offer 24-hour liquidity, click the link below to view iSystems Trade & Market FactorsThe 90-day pause on reciprocal tariffs between the U.S. and China is set to expire on August 12th. It’s possible that a trade deal could be reached ahead of that deadline. In June, China imported 9.73 million tons (mt) of soybeans from Brazil and only 724k tons from the U.S. According to Reuters, China is estimated to import 10.48 mt of soybeans in July. If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

Soybean MealFunds are record short on soybean meal. The Indonesia trade deal, yesterday, includes a commitment of $4.5 billion in U.S. agricultural purchases. Indonesia is a top 10 destination for soybean meal exports. President Trump also mentioned more trade deals would be announced soon. A trade deal with India could be next. If you wanted to trade soybean meal, you could look at buying short-term calls and selling out-of-the-money calls on a bounce. Soybean OilThe oil share has climbed from 49.625% last Thursday to back over 50% yesterday. The oil share was lower today, but it looks to be headed to 55%. Soybean oil continues to stay steady on expectations for stronger biofuel demand in 2026/27. Soybean oil stocks for June were 1.366 billion pounds (bp), below the trade estimate of 1.374 bp, which is the lowest June oil stock figure since 2004. There could be a good opportunity to sell puts if soybean oil breaks and use the credit to buy soybean calls. SoybeansThe maximum profit on the September soybean trade is 41 3/8 cents or $2,068.75, if soybeans trade 1080 or better. The maximum loss is limited to the price of the spread at 8 5/8 cents or $431.25. Breakeven = 1038 5/8. ALL PRICES ARE WEDNESDAY'S SETTLEMENT PRICES If you’re ready to open an account with Walsh Trading, please use the link below Hans Schmit, Walsh Trading Direct 312-765-7311 Toll Free 800-993-5449 hschmit@walshtrading.com www.walshtrading.com Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71. This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

||||||||||||

|

|